STATEWIDE – As of November 2022, interest rates are still sitting over 7% – impacting affordability, however, there’s a program available to help buyers bring down the cost of getting into a home. California Housing Finance Agency’s (CalHFA) Forgivable Equity Builder Loan provides homebuyers a forgivable loan up to 10% of the purchase price of a home to use for the down payment.

According to the CALHFA website, home equity has proven to be one of the strongest ways for families to build and pass on intergenerational wealth. CalHFA is committed to improving equitable access to homeownership for all Californians.

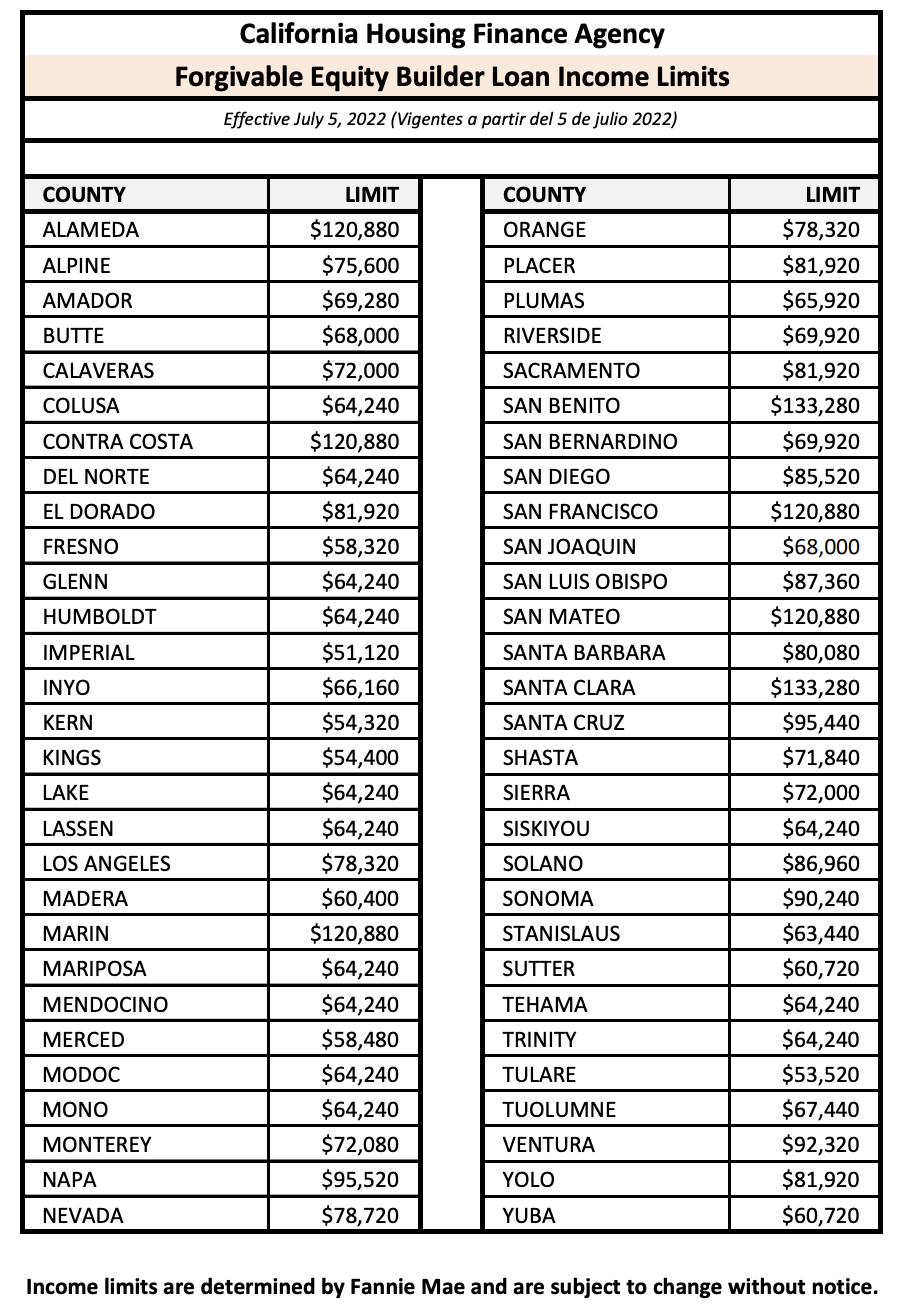

The loan is available to middle-income families that meet the income limit requirement.

Forgivable Equity Builder loan requirements

The loan is forgivable if the homebuyer occupies the home for 5 years. Non-occupant co-borrowers are not allowed. Single-family, one-unit residence, manufactured homes and condominiums are eligible properties. Guest houses, granny units and in-law quarters may also be eligible.

RELATED: CALHFA: Homeowners get $25K for Granny Flat

CalHFA borrowers must complete eHome’s 8-hour Homebuyer Education and obtain a certificate of completion. The course costs $99. Homebuyer counseling is also included with the course. An in-person course is also available through NeighborWorks America or any HUD-Approved Housing Counseling Agency

California Housing Price Increase

In California, the median home price is up more than 20% since the beginning of the COVID-19 pandemic. Even though the housing market is cooling, interest rates have impacted buying power.

According to CNBC, at the end of 2021, a homebuyer with a monthly mortgage budget of $2,500 could afford a home worth up to $517,500. But for the four-week period ending June 15, 2022, that same homebuyer could only afford a home worth up to $399,750 — a $120,000 drop in purchasing power.

Although the Forgivable Equity Builder loan is 0% interest, a portion of the loan will have to be paid back if the home is occupied for less than five years.

For more information about the Forgivable Equity Builder loan visit https://www.calhfa.ca.gov/homebuyer/programs/forgivable.htm