CALIFORNIA – The California Legislative Analyst’s Office (LAO) published a report, December 2, with recommendations that include increasing taxes employers pay for unemployment insurance (UI) to fix projected $2 billion annual deficits over the next five years.

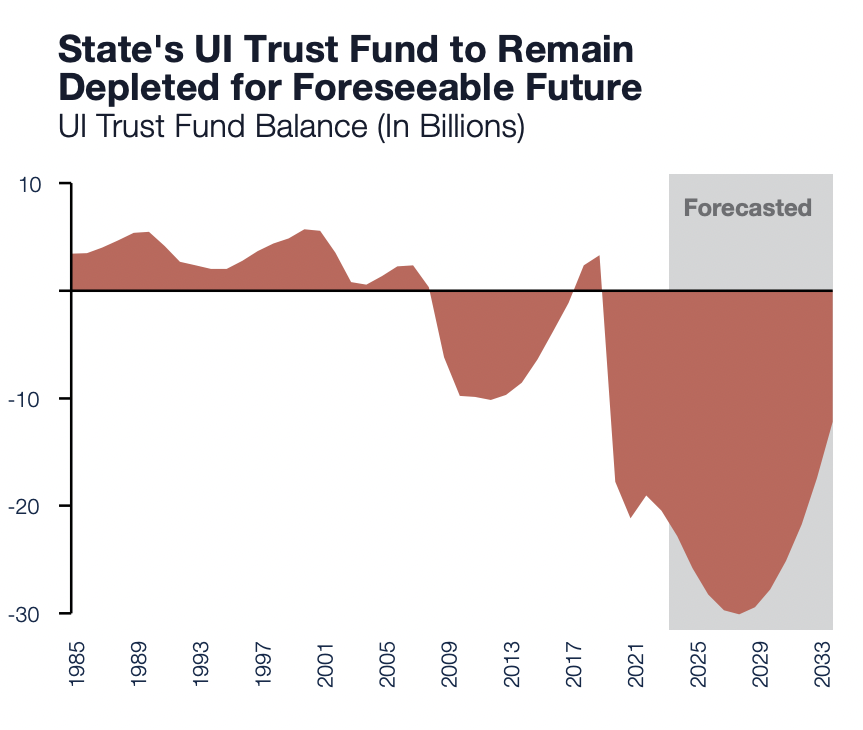

With deficits, LAO says the state has not yet made progress repaying the outstanding $20 billion federal loan used to cover benefits during the pandemic.

Outlook is unprecedented

LAO analyst Gabriel Petek says the UI system is broken as tax collections routinely fall short of covering benefit costs.

“This outlook is unprecedented: although the state has, in the past, failed to build robust reserves during periods of economic growth, it has never before run persistent deficits during one of these periods,” said Petek.

Petek says unless changes are made, the state will have no reserves when the next recession begins.

Recommendation could increase taxes from $250 to $1000 per employee

Petek’s first recommendation is to increase the taxable wage base.

Employers currently pay unemployment insurance taxes on the first $7,000 of each employee’s annual earnings. According to LAO this is one of the lowest wage bases in the U.S. and has not changed since 1984.

Petek recommends the taxable wage base to increase to $46,800. He also says a UI tax structure should be comprised of a standard tax rate and a reserve-building tax rate for a total of 1.9% applied to the proposed $46,800 taxable wage base.

For example, an employer pays about $250 per year in UI taxes per employee making minimum wage. (This amount will increase to about $450 in the coming years to repay the federal loans.)

Under the recommended approach, the same employer would pay about $700 per year in the short term while the state is building a reserve and employers are repaying the revenue bond. (Employer taxes would decline thereafter.)

For an employee making any amount more than $46,800, employers’ taxes would increase to around $1,000 per year.

Maximum weekly benefit amount would be $765 adjusted for inflation

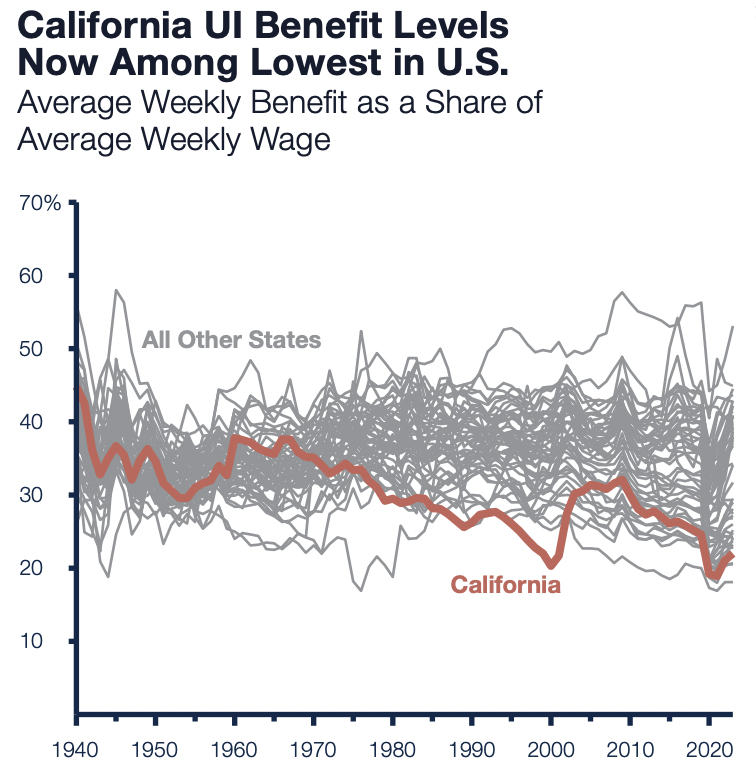

The report says that the financing issues also undermine some of the objectives of the program – one of which is California’s benefits are not indexed to inflation.

“UI benefits increase with income, but the maximum amount a worker can receive is $450 per week—a level set in legislation passed in 2001. If this benefit level had been adjusted for inflation, the state’s maximum weekly benefit amount would be $765 today,” said Petek.

Additional concerns under the current tax system are less than half of unemployed workers receive UI benefits, and it deters hiring of low-wage workers, according to Petek.

Recommendations will result in significant tax increases for employers

In addition to an increase in the taxable wage base, the analyst recommends a new experience rating system and a refinance of the federal loan with shared participation between businesses and the state.

Petek acknowledges that the recommendations will result in significant tax increases for employers, however he says the state’s employers will pay higher UI costs one way or another.

“The reason for this is the state’s significant UI loan, which will need to be repaid with an annually escalating federal surcharge that is likely to reach at least 3 percent and could climb as high as 5.4 percent,” said Petek.

He goes on to say that making changes now will allow the Legislature to make choices about how to repay the federal loan, while also replacing the UI financing system with one that is simpler, balanced, and flexible.

To read the full report visit https://lao.ca.gov/Publications/Detail/4943

RELATED: EDD agrees to cancel an estimated 5,000 Notices of Overpayment