![]()

SAN BERNARDINO COUNTY – After collecting over 11,000 signatures, San Bernardino County residents have put a repeal of a $46.5 million special tax for Fire Protection District Zone 5 (FP-5) back on the ballot, March 5, 2024.

In the October 24 meeting, San Bernardino County Board of Supervisors approved the community initiative to be placed on the ballot without the full text.

Violation of California Constitution

According to the Red Brennan Group, FP-5 was originally implemented via a voter-approved special tax to supplement fire services in Helendale.

“Exactly 1,022 residents voted to self-impose the additional tax. This election complied with all legal requirements and met the two-thirds approval requirement stipulated by the California Constitution,” said the Red Brennan Group website.

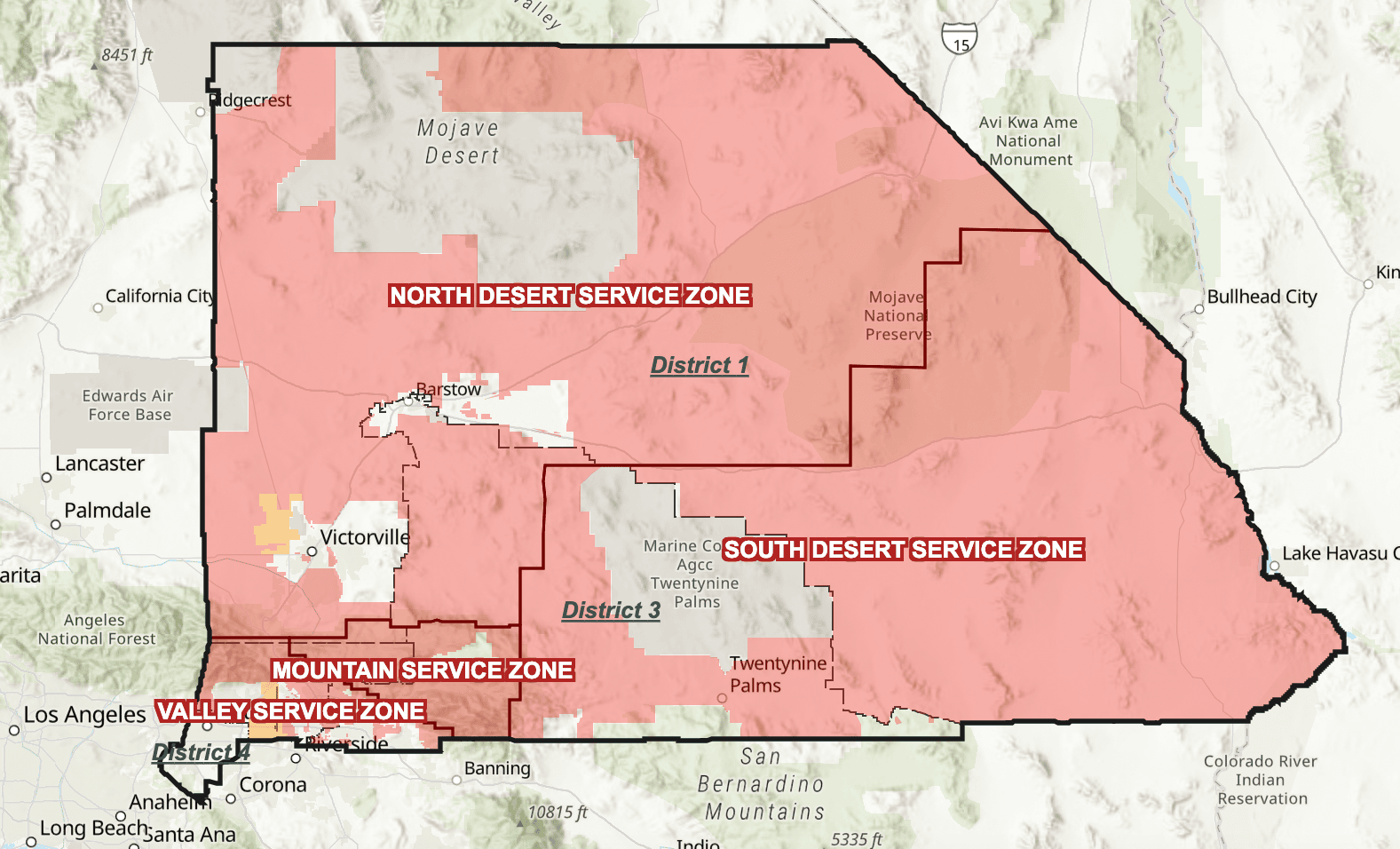

However, in October 2018, the group says the board of supervisors voted to expand the zone to include 95% of San Bernardino County. A tax of $161.9 is charged per parcel annually.

Proponents of the repeal say the imposed tax violates the California Constitution.

“No local government may impose, extend or increase a special tax unless that tax is submitted to the electorate and approved by two-thirds vote,” said San Bernardino County resident Tom Murphy during the meeting’s public comments.

Murphy goes on to say that district voters chose to repeal this tax via Measure Z.

Measure Z passed with a 59% vote, in 2022, however, San Bernardino Superior Court Judge David Cohn ruled the vote invalid and said it would not be enforced.

Less fire protection

San Bernardino County Fire Chief Dan Munsey said, during the meeting, that the special tax represents 19% of their operating budget.

“This would result in less fire protection – emergency services to the public,” said Munsey. “We are a California Special District, as such, we are not a department of the county. We are not guaranteed any general fund support.”

County Supervisor Joe Baca Jr. said he has concerns with the repeal.

“I know that the city of San Bernardino, Muscoy and Bloomington do rely on FP-5 and it could be a big concern” said Baca Jr. “It could potentially impact our communities, especially the City of San Bernardino which has the highest amount of calls per service in the country.”

Baca said the people are going to ultimately decide to repeal the special tax.

Residents can register to vote for the upcoming election at https://sbcountyelections.com/voterregistration/how/

RELATED: New law protects Californians from over-priced ambulance bills