CALIFORNIA – The California Economic Forecast, published October 11, reported that due to the Federal Reserve’s aggressive monetary policy – in the form of interest rate hikes, the labor market is very likely to show more pronounced slowdowns in job creation and job turnover over the next six months.

Strong labor market is bad news to the Fed

According to the report, the September employment report indicated that twice as many new jobs were created — 336,000, than had been forecast by economists.

However, the report says this is bad news to the Fed.

“The news is that the labor market remains strong. Typically that is good news. But good news about the labor market in the current environment is bad news for the Federal Reserve as its main goal now is to bring down inflation,” said the report.

For September, overall inflation is 3.7 percent.

The report says that unless there is clear progress of inflation approaching the Fed’s 2.0 percent target, continued aggressive monetary policy in the form of interest rate hikes are probable.

Curbing spending to combat inflation

The Federal Reserve believes that when they raise interest rates, it can help lower inflation by making it more expensive for people and businesses to borrow money, which can discourage them from spending.

The report says that higher interest rates will ultimately take their toll on more than just the housing and new car sales markets.

- Consumers are reeling in their spending;

- Using credit to consume is less attractive with high interest rates;

- Higher rates also discourage business investment, which slowed in May, June and July;

- Fewer goods can be purchased with the same expenditure level, due to inflation;

- Fewer goods sold mean less sales, lower earnings of corporations, and lower stock prices.

RELATED: Report says $90,399 annually is needed for Californians to live comfortably in retirement

Recession likely avoided in 2024

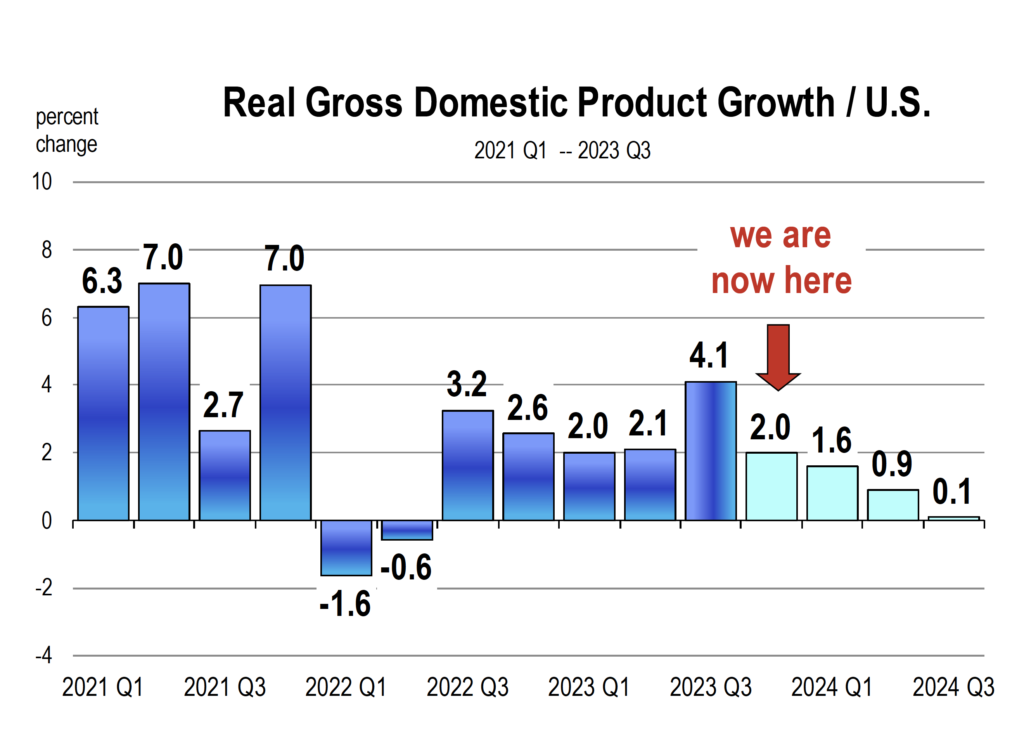

The UCLA Anderson School forecast has growth slowing to less than one percent by mid-2024.

The report says that next year, a bona fide recession is avoided but the economy will grow slowly. There’s a possibility that it could tip into a mild recession lasting for about two quarters.

In addition, overall inflation will remain in the 3.0 to 3.3 percent range. Mortgage rates will stay high throughout 2024 and begin to contract in 2025.

To read the full report visit https://californiaforecast.com/october-2023/