![]()

STATEWIDE – The new California budget, approved this week, restored $50 million in funding for the Accessory Dwelling Unit (ADU) program. The program helps homeowners add an accessory dwelling unit to their property, in part, to help relieve the housing crisis in California.

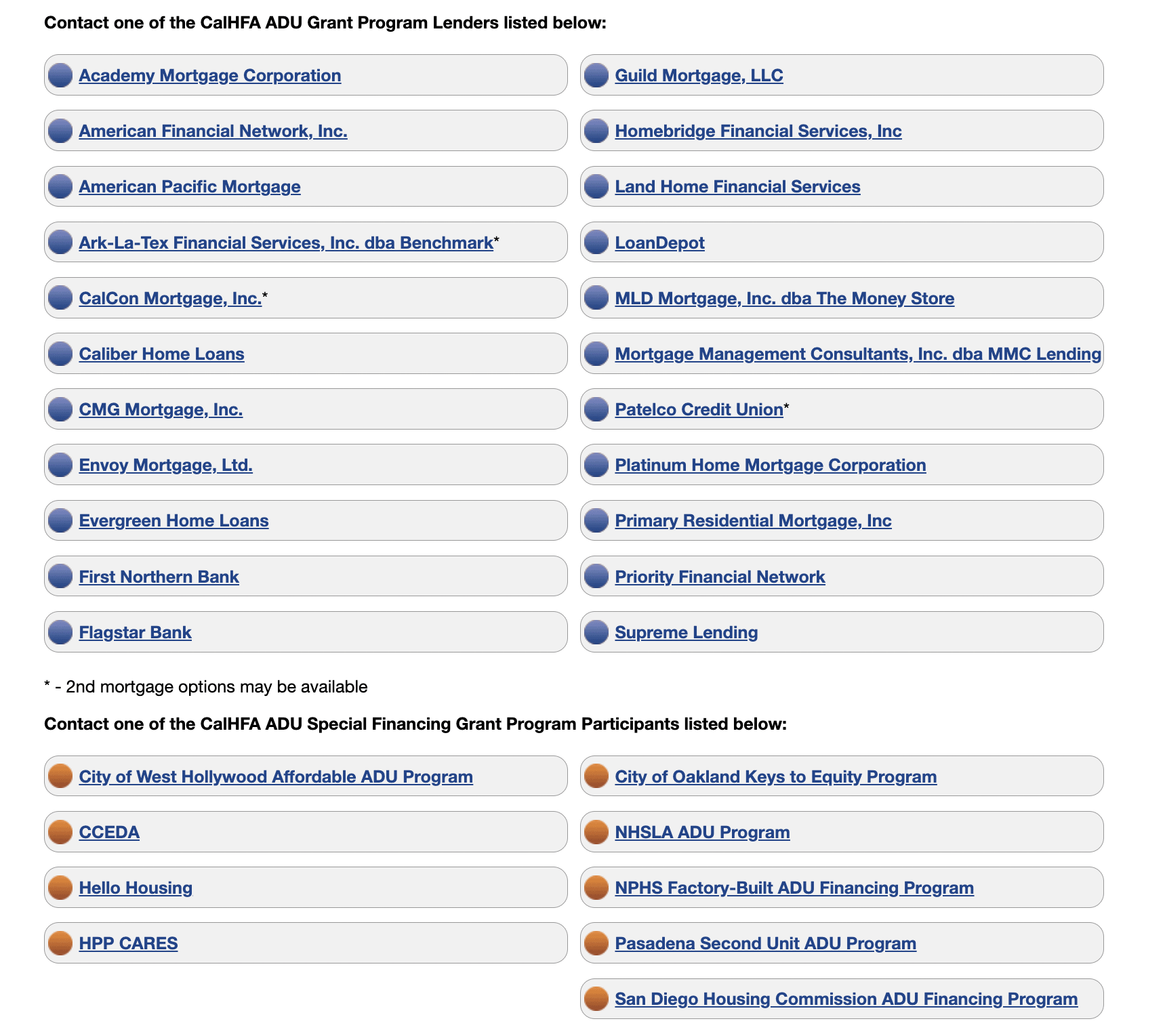

The California Finance Housing Agency (CalHFA) provides homeowners with $40,000 reimbursements for pre-development costs associated with the construction of an ADU.

In March, CalHFA said funding was fully reserved for the ADU program and stopped accepting applications.

The CA 2023 – 2024 budget approval restores the $50 million to the program.

Although there isn’t a date yet for the program to resume, CalHFA sends out updates on the program that can be subscribed to by clicking here.

Low to moderate income homeowners are eligible to apply for funding.

California Housing Crisis

ADUs – also known as granny flats, in-law units, or backyard cottages, is a secondary housing unit on a residential lot. CalHFA implemented the grant program to address the housing crisis in California.

The passage of Senate Bill 9 allows for homeowners to build up to four homes on a single-family parcel, however, a recent report found that its impact has been limited so far.

RELATED: Financial assistance up to $2,000 for water bill available for qualifying households

“Planners told us that while applications for SB 9 have been low, inquiries to their departments about SB 9 are high,” says a January 2023 UC Berkeley report.

The study outlines how lawmakers can improve uptake of the housing law:

Create more prescriptive state standards for SB 9 homes

SB 9 uptake could be improved by creating more prescriptive land use and zoning standards to enable greater SB 9 feasibility.

Adopt more flexible local SB 9 ordinances

Local policymakers can consider adopting policies to improve SB 9 uptake, such as limiting fees and creating clear guidance and procedure for homeowners.

Address homeownership barriers

Legislators should reassess requirements under certain policies such as the Subdivision Map Act and construction defect liability laws which increase costs and deter the construction of homeownership projects.

For more information about the ADU Grant program visit https://www.calhfa.ca.gov/adu/