STATEWIDE – California Housing Finance Agency (CalHFA) announced, Friday, that all the funds for the Dream For All Shared Appreciation (DFA) Loan are reserved. The program will be paused at this time – two weeks after going live on the CalHFA website.

In a program bulletin dated April 6, 2023, CalHFA stated they anticipate all funds currently available for the DFA Shared Appreciation Loan could be fully committed as soon as April 10, 2023. The following day, they announced that current funds for the program have been reserved as of April 7, 2023.

“However, all loans must be rate locked no later than 3 p.m. PST on April 12, 2023, or when the available funds become fully committed, whichever is sooner. Loan files that do not have rate locks by that time will not be funded. Loan files attached to floating reservations are not committed and will be canceled the day after the program pauses,” states the CalHFA program bulletin.

The bulletin also states that loans for new construction properties need to be rate locked by 3 p.m. PST on April 12, 2023.

The $300 million in DFA funding currently available to CalHFA is expected to help more than 2300 low- and moderate-income Californians purchase their first homes.

CalHFA says they are extremely proud of this successful program and pleased to make such a profound difference in the lives of so many Californians who have achieved the dream of homeownership.

Dream For All Shared Appreciation Down Payment Assistance

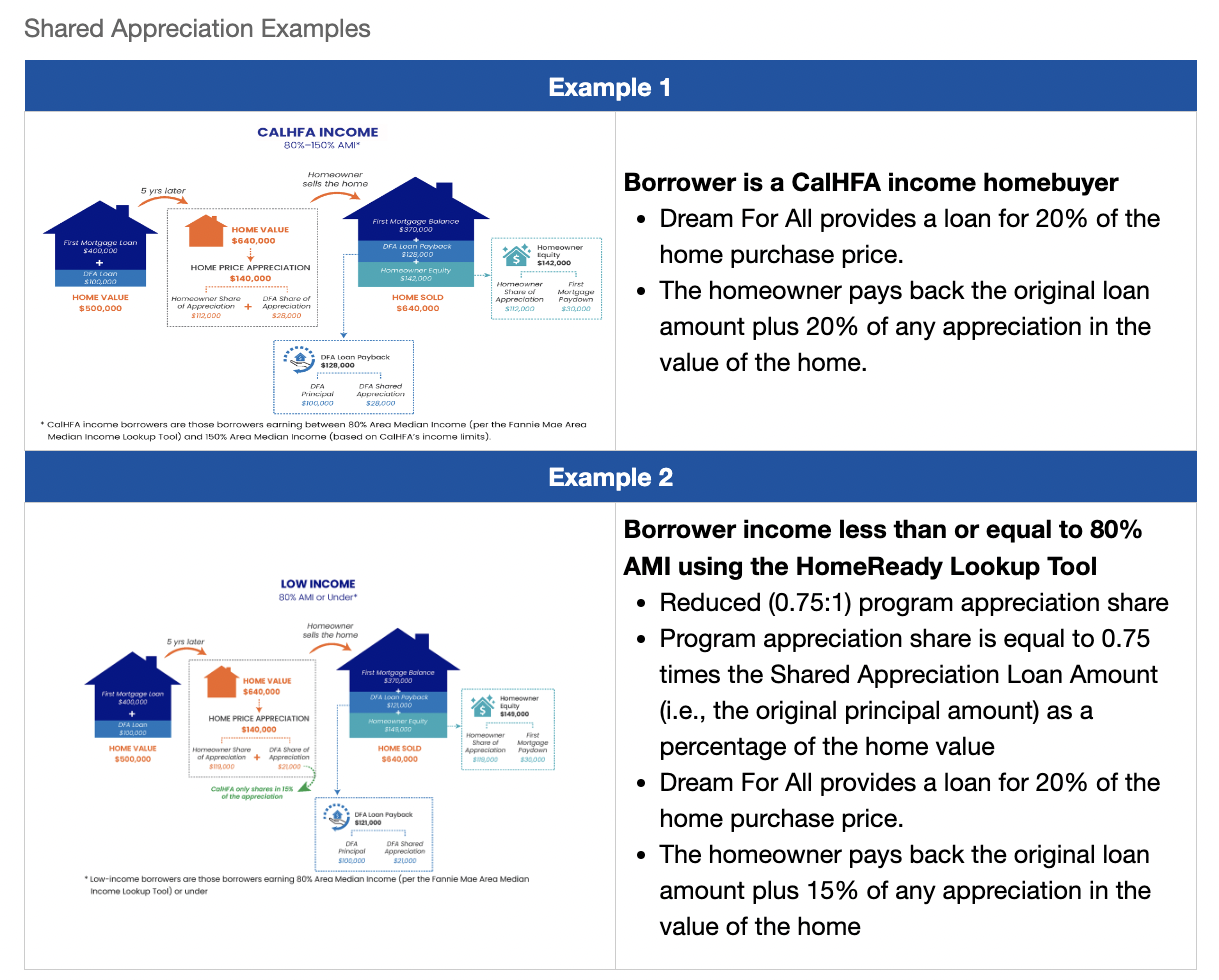

CalHFA announced on March 26, that the DFA Shared Appreciation loan information was posted on their website. The first-time homebuyers program provides up to 20% down payment assistance in return for a share of the appreciation in the home’s value.

The DFA Shared Appreciation Loan is to be used in conjunction with the DFA Conventional first mortgage for down payment and closing costs. Upon sale or transfer of the home, the homebuyer repays the original down payment loan, plus a share of the appreciation in the value of the home.

How the loan works

CalHFA provides examples of how the program works.

A low income borrower who purchases a home for $500,000 would receive $100,000 for the downpayment and closing costs. After 5 years of appreciation, CalHFA estimates the new home value at $640,000. If the borrower decides to sell, they would owe the $100,000 and 15% of the appreciation – $121,000 total. Their homeowner equity would amount to $149,000.

In the same scenario, a moderate income borrower would owe $100,000 and 20% of the appreciation, in this case, $128,000 total. The home equity would amount to $142,000.

Other details

Repayment of the DFA principal and any share of the appreciation on the Shared Appreciation Loan is due and payable at the earliest of the following events:

- Transfer of title

- Sale of the property

- Payoff of the first loan

- Payoff of the subordinate loan principal balance

- Refinance of the first loan – see program handbook for details

- The formal filing and recording of a Notice of Default (unless rescinded)

RELATED: WISH grant provides first time homebuyers up to $22,000 for downpayment

There is a cap on the amount of appreciation owed. The most a borrower will ever repay is 2.5 times the original loan amount. If the appreciation of the property is zero or less, no additional monies would be due.

For future updates on the California Dream For All Shared Appreciation Loan sign up for the CalHFA eNews at https://www.calhfa.ca.gov/dream/index.htm?utm_medium=email&utm_source=govdelivery