VICTORVILLE – Clear Capital, a West Coast private equity investment firm specializing in multifamily housing, announced Wednesday the acquisition of Aspire Seneca for $15.5 million. The company says they will have the opportunity to raise rents after renovations and upgrading the community’s amenities.

In a Facebook post, Clear Capital said they are going to do what they do best — add value to the building.

“At Aspire Seneca, we have the opportunity to increase rents through renovating units, upgrading amenities and reducing costs by improving the assets operating efficiency and creating a compelling value-add investment opportunity for our clients,” said Clear Capital Founding Partner Eric Sussman. “With planned renovations, the property is projected to yield a project-level IRR north of 15% over a 5-year holding period.”

An Internal Rate of Return or IRR is a metric used in financial analysis to estimate the profitability of potential investments. Generally speaking, the higher an internal rate of return, the more desirable an investment is to undertake.

The company says this is its 39th investment offering – accredited investors can invest alongside Clear Capital with a minimum $25,000.

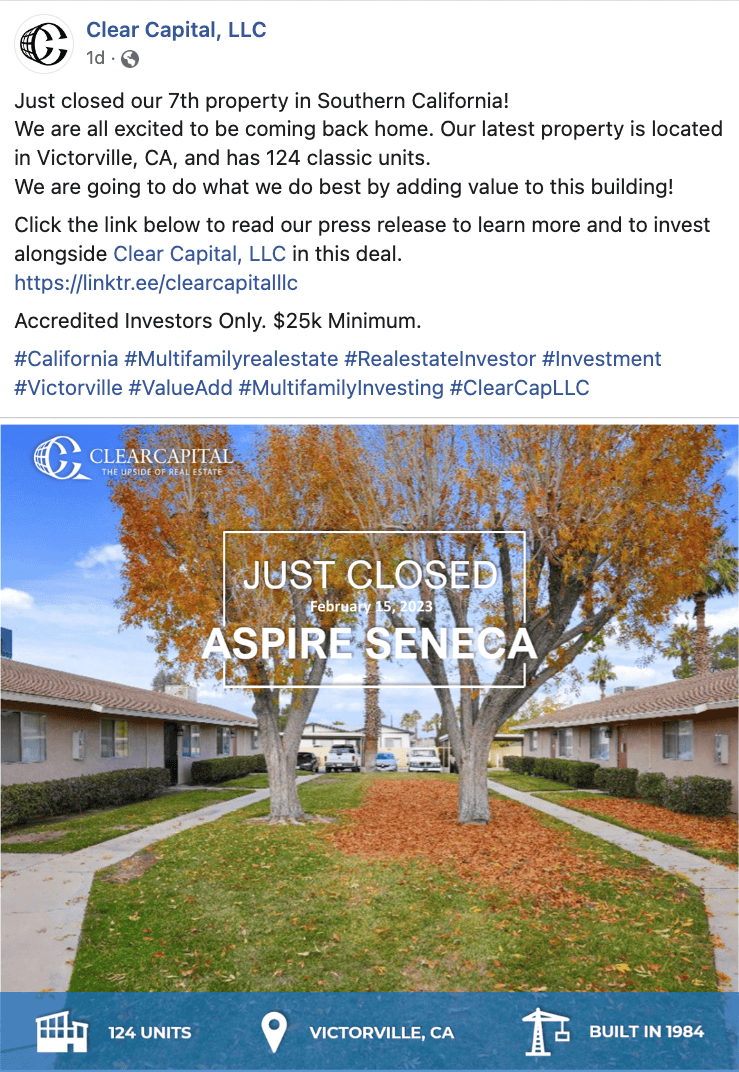

Aspire Seneca

Formerly known as Gold West, Aspire Seneca was built in 1984. It has 124 one-, two-, and three-bedroom units with condo-style floor plans in original condition. Each unit averages 770 square feet. The property has two pools, sundecks, and covered parking. Prospective residents can see the property along Seneca Road. This makes for high visibility along their daily commute.

Clear Capital says the community will be soon in high demand as Victorville recently came in No. 13 on SmartAsset’s top 100 boomtowns in America.

RELATED: Victorville and Hesperia make top 100 Boomtowns in America for 2022

“Leveraging a 1031 exchange and capital raise, this is an outstanding investment opportunity in a community soon to be in high demand,” said Sussman.

The company says Victorville is also the leading city for a number of industries including aviation, manufacturing, distribution, and retail. The property is within minutes from neighborhood destinations including Victor Plaza Shopping Center, Costco, In-N-Out Burger, Starbucks, and Kaiser Permanente.

For more information or to make an investment, please visit www.clearcapllc.com.