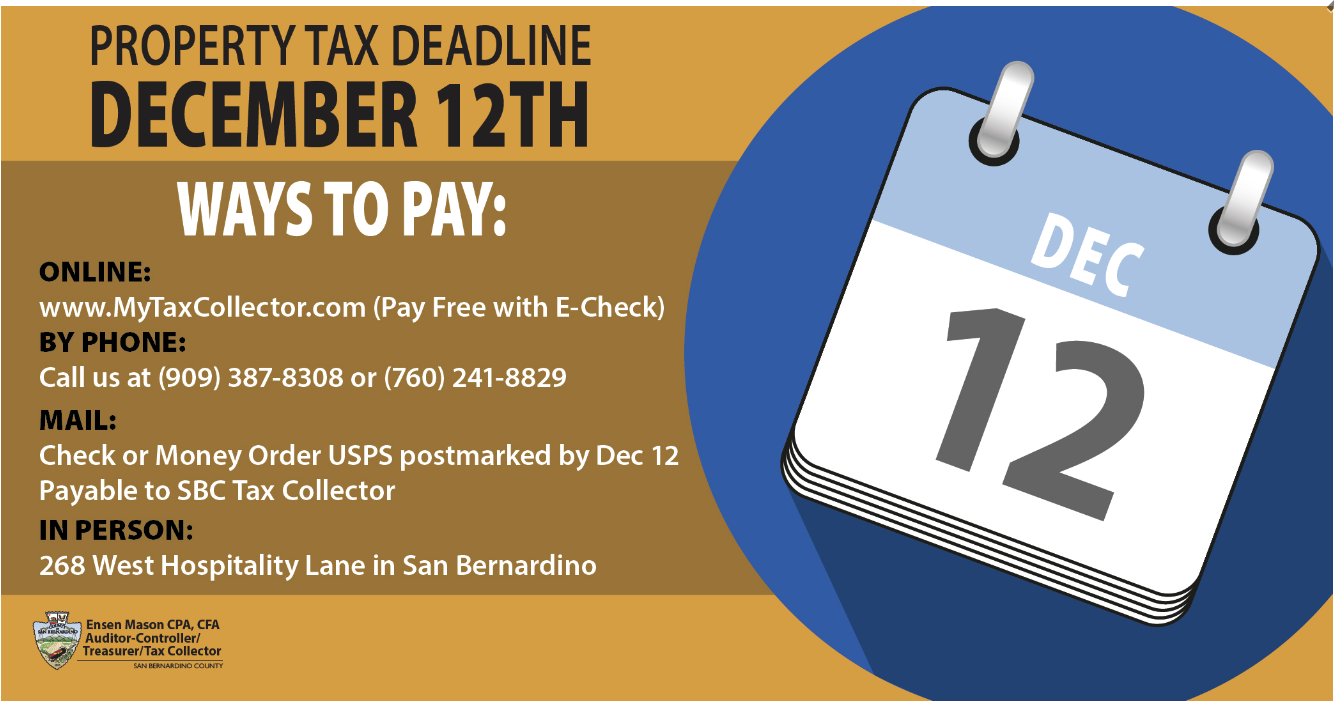

SAN BERNARDINO COUNTY – The deadline to pay property taxes is approaching – the last day to pay without incurring a 10% late fee is Dec. 12. The San Bernardino County Tax Collector’s Office offers several ways to pay, including online, by phone, by mail, and in person.

“Property taxes fund key public services that enhance the quality of life for county residents,” said San Bernardino County Tax Auditor-Controller, Treasurer, Tax Collector (ATC) Ensen Mason. “I recommend taxpayers take advantage of ATC’s easy and secure online payment options at www.MyTaxCollector.com, and I encourage property owners to do what they can to pay their property taxes by December 12 to avoid costly penalties as a result of late payments.”

Electronic payments are accepted online at www.MyTaxCollector.com, and by phone at (909) 387-8308 or (760) 241-8829. Payments can be made using a checking or savings account free of charge.

Mailed payments should be sent to San Bernardino County Tax Collector at 268 West Hospitality Lane, First Floor, San Bernardino, CA 92415-0360. Only payments with a USPS postmark cancellation on or before December 12, 2022, will be considered timely.

For payments made in person at the Tax Collector’s office, it is recommended to bring a copy of the tax bill for faster service. Business hours are Monday through Friday, 8:00 a.m. – 5:00 p.m.

In related news, residents can check the San Bernardino County website for an unclaimed property tax refund.

The Property Tax Division issues refunds as a result of reductions to assessed valuations such as exemptions, proposition 8 reductions and assessment corrections. In all cases, either a refund claim form or a warrant is mailed to the address on file, however, many of these refunds remain unclaimed.

With certain exceptions, taxpayers generally have four years to file a claim for the refund.

To search for an unclaimed property tax refund with San Bernardino County visit https://www.sbcounty.gov/atc/pirfnet