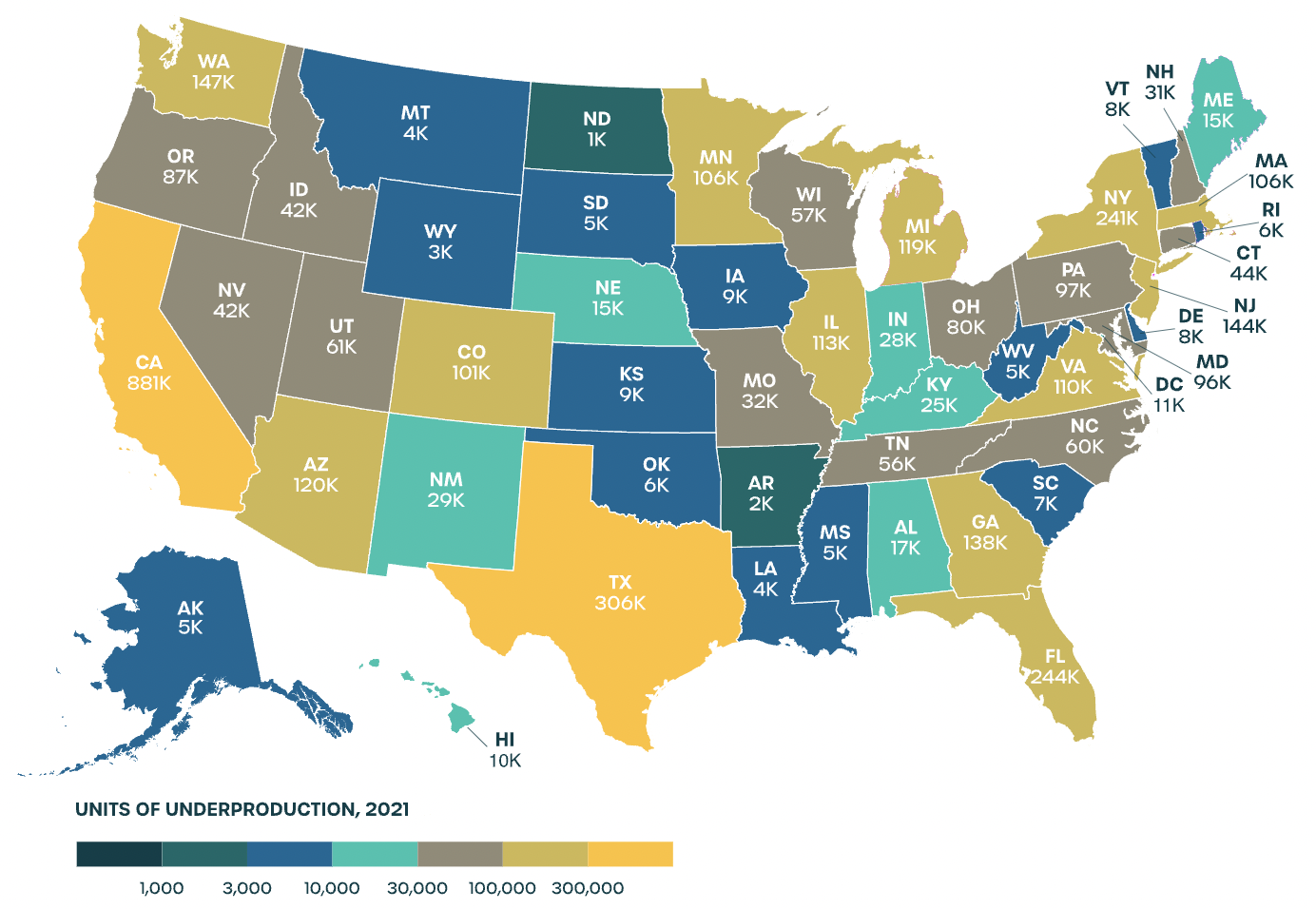

CALIFORNIA – A new Up For Growth report lists California highest in the nation for housing underproduction with 881,000 units in 2021.

“Underproduction” means that the number of new housing units being constructed or made available is insufficient to meet the demand. This can result in various housing-related challenges, such as rising home prices, increased rental costs, housing shortages, and, in some cases, overcrowding.

The report breaks down underproduction units by metropolitan areas. The Los Angeles region ranked number two, nationwide, with 332,275 underproduction units. The Inland Empire ranked number three at 160,841 units.

Exclusionary zoning practices and NIMBYISM

The report attributes the underproduction to US housing policies dating back prior to the Great Depression.

“A legacy of exclusionary zoning practices, restrictive land use codes, and discriminatory housing policies has made it very difficult for builders to meet Americans’ changing housing needs and preferences,” said the Up For Growth report.

The report says the rise of the environmental protection movement in the 1960s and 70s offered NIMBY – Not In My Backyard activists tools for opposing development.

“Legislation like the National Environmental Policy Act (NEPA), intended to protect natural resources, also empowered local resistance against housing projects, making new development more difficult,” said the report.

The study cites a 2019 survey of over 800 developers, investment firms, and property managers from across the country. They said the most common barrier to new building is NIMBY complaints with 45% of developers stating that it is fairly or extremely difficult to build new multifamily housing.

“It is very difficult to quantify the number of projects that never reach fruition due to NIMBY opposition,” said the report. “Often, projects die before application because of the mere threat of it. But, it is easy to surmise that, across the country, NIMBY opposition is responsible for an astonishing number of projects never getting built.”

Banning rent control and other solutions

The report highlights state and local governments across the country that they say are addressing the housing underproduction problem.

In Florida, the report says the state legislature passed the Live Local Act, banning localities from implementing rent control. The report notes that if today’s rent control measures pass, we could expect to see owners remove their properties from the rental market, disinvestment in existing rental properties, and a decrease in production of new housing.

Florida is also providing historic funding levels for workforce housing and by-right permissions for residential in high-opportunity neighborhoods across the state.

Other solutions listed include zoning reforms and new funding sources.

To read the full up for Growth Report visit https://upforgrowth.org/apply-the-vision/2023-housing-underproduction/