CALIFORNIA – California Congressional Members sent a letter, dated November 6, to Insurance Commissioner Ricardo Lara urging him to use his power under state law to stabilize the insurance market and protect consumers.

The letter, signed by 30 members, is a response to Lara’s Sustainable Insurance Strategy, which they say could diminish the Insurance Commissioner’s regulatory power.

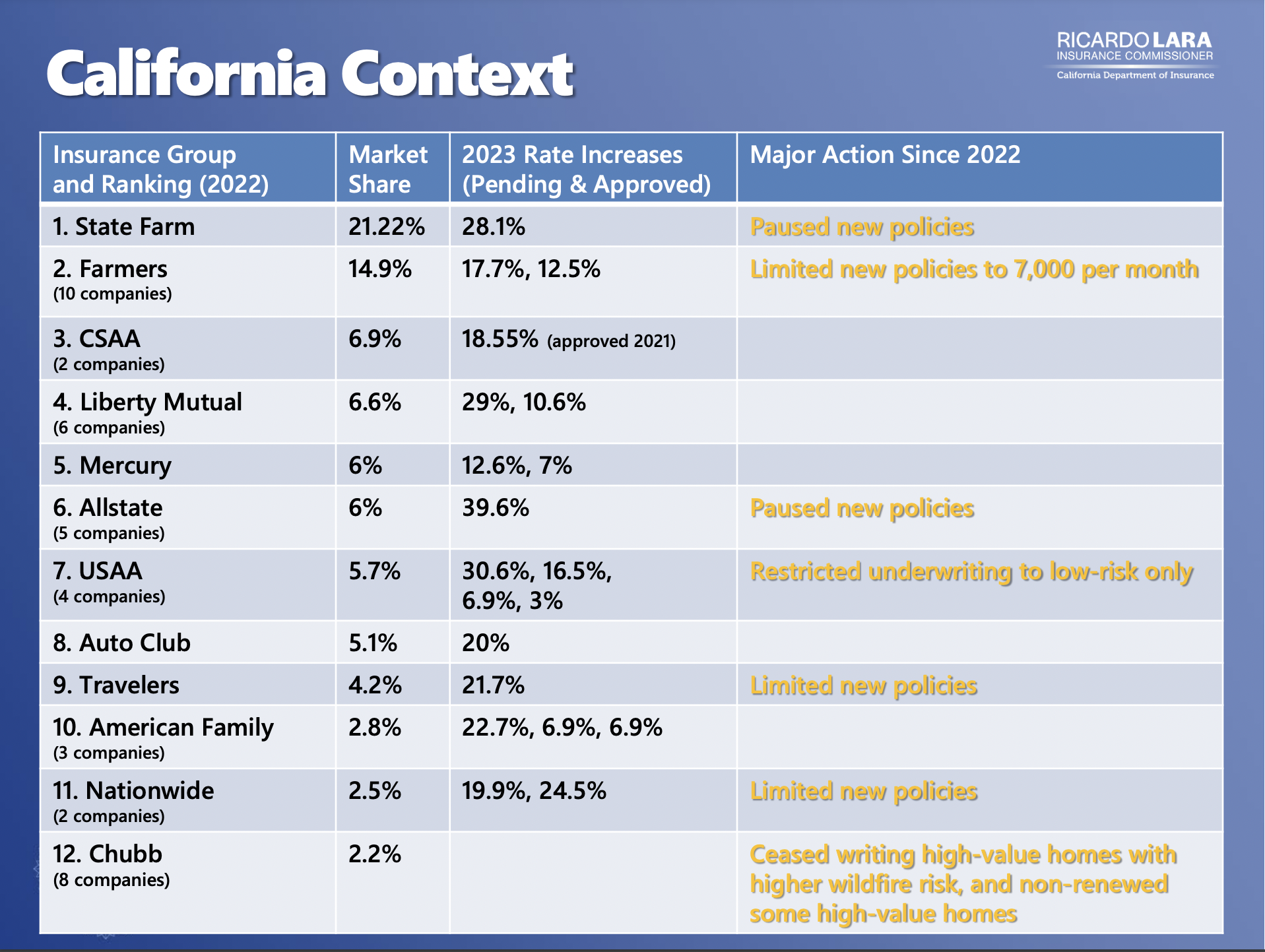

Companies pause business despite approved increases

According to the Department of Insurance, the top 12 companies – 85% of California’s homeowners market, have paused or restricted new business despite approved or pending rate increases. Many cite wildfire risks as the cause.

CA Congressional Members say that under Proposition 103 – a 1988 ballot measure that requires prior approval for any future rate increases, Lara has the power to stabilize the statewide insurance market.

However, they say his plan appears to propose significant alterations to the Commissioner’s regulatory authority – potentially leading to a reduction in the power granted by California voters.

Sustainable Insurance Strategy

Executive actions for the Sustainable Insurance Strategy include transitioning homeowners and businesses from the FAIR Plan – an insurance of last resort, back into the normal insurance market.

In return, insurance companies will commit to cover least 85% of their statewide market share in wildfire-distressed underserved areas if the state allows them to use catastrophe models to estimate their economic losses from future disasters.

Concerns with the strategy

Congressional Members say that the concerns they have over the Sustainable Insurance strategy could threaten consumer protections established in Proposition 103.

These concerns include:

- Using proprietary forward-predicting models;

- Expediting rate reviews that limit public comment;

- Allowing insurance companies to abandon certain regions of the state;

- Incorporating reinsurance costs into California rates.

“We believe it is important to keep California consumer interests at the forefront of your decision-making process,” stated the members in the letter.

Timeline for changes

The Department of Insurance website says they will implement the Sustainable Insurance Strategy by December 2024.

“Some elements of the strategy will be executed even sooner to address pressing consumer and market issues. Commissioner Lara stresses the urgency of these reforms, given the challenges posed by climate change,” said the site.

For more information about the Sustainable Insurance Strategy click here.

RELATED: Insurance Commissioner approves AI model — advocates say rates may go 2 to 3 times higher