STATEWIDE – Effective July 1, the tax on gas in California increases to 58 cents per gallon – up from 54 cents per gallon. According to the state, a portion of generated revenue will pay for deferred maintenance on the state highway system and the local street and road system.

National Gas Price Average vs. CA Gas Price Average

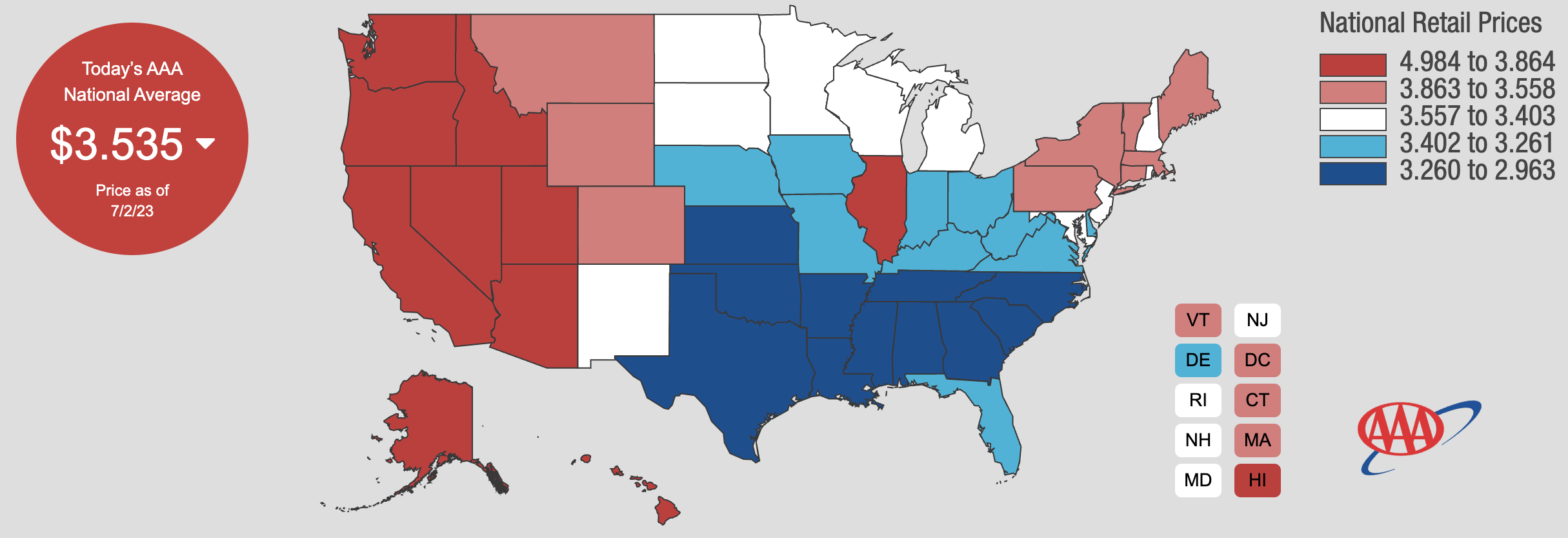

As of July 2, AAA estimates the national average price per gallon of gas as $3.53. In California, the average is $4.83.

Annual Gas Tax Increase

The annual increase was approved in SB-1 transportation and funding, signed into law in 2017, allocates funding to not only road maintenance but workforce training, freeway service patrol, local planning grants, and transportation research.

The state says California motorists are spending $17 billion annually in extra maintenance and car repair bills, which is more than $700 per driver, due to the state’s poorly maintained roads.

“A funding program will help address a portion of the maintenance backlog on the state’s road system and will stop the growth of the problem,” states the SB-1 legislation.

Proposal to switch to mileage tax

With more electric and hybrid vehicles on the road, Caltrans and state officials are considering a new mile-based tax system – a road charge, that would replace the state’s current gas tax.

“Instead of paying the state’s gas tax, which disproportionately impacts those who cannot afford more fuel-efficient vehicles, everyone would pay a per-mile fee for how much they use the road, regardless of what kind of car they drive,” says a statement on the California Road Charge website.

A 4 cents per mile rate for a commuter who drives 4,000 miles per month would total to a $160 a month road charge.

RELATED: CA gas price gouging law went into effect Monday

California Road Charge’s Public/Private Roads Project is currently underway in rural communities. The pilot program aims to demonstrate the ability of current GPS technology to differentiate when a car is driving on a public versus a private road, while protecting the user’s privacy.

Currently, when a driver is on a private road, they are still paying the gas tax even though no public money goes to the maintenance of that road.

Opposition to proposed Mileage Tax

According to Reform California not only is the proposed mileage tax an invasion of privacy – as it would include a tracking requirement that is still being determined, but the typical California driver will be forced to pay $600-800 a year in higher taxes.

To estimate the proposed mileage tax visit the Road Charge calculator at https://caroadcharge.com/