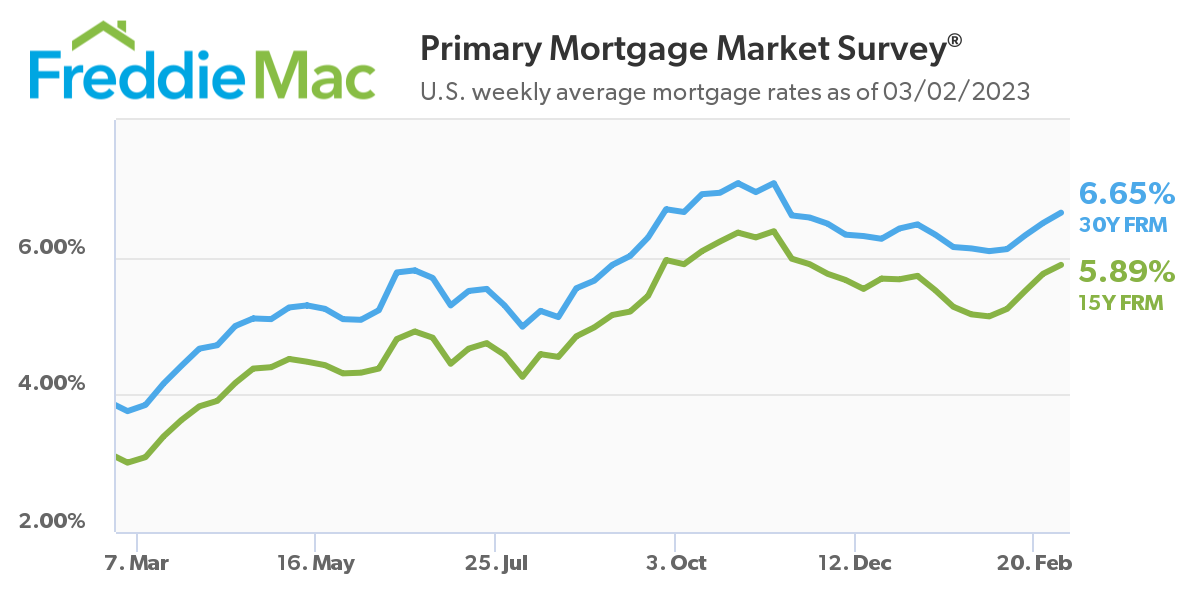

NATIONWIDE – Freddie Mac released the results of its Primary Mortgage Survey, Thursday, showing the 30-year fixed-rate mortgage (FRM) averaged 6.65 percent. This is up from last week when it averaged 6.50 percent.

The 15-year fixed-rate mortgage averaged 5.89 percent, up from last week when it averaged 5.76 percent.

“As we started the year, the 30-year fixed-rate mortgage decreased with expectations of lower economic growth, inflation and a loosening of monetary policy. However, given sustained economic growth and continued inflation, mortgage rates boomeranged and are inching up toward seven percent,” said Freddie Mac Chief Economist Sam Khater.

Khater says lower mortgage rates in January brought buyers back into the market. However, now that rates are moving up, affordability is hindered making it difficult for potential buyers to act, particularly for repeat buyers with existing mortgages at less than half of current rates.

A year ago at this time, the 30-year FRM averaged 3.76 percent.

2023 Housing Market Predictions

Mortgage experts have differing opinions on where mortgage rates will be by the end of the year.

City University of New York Professor Dennis Shirshikov foresees the 30-year and 15-year mortgage loans averaging 8.75 percent and 8.25 percent, respectively, across 2023.

“Continued inflation, overall higher interest rates, a potential recession, and geopolitical tensions will force 30-year and 15-year mortgage rates up throughout 2023 and will bring the two rates closer together as short-term risks rise,” said Shirshikov.

ATTOM Data Executive Vice President of Market Intelligence Solutions Rick Sharga says that rates will peak at about 8 percent and 7.25 percent for 30-year and 15-year loans in early 2023 but gradually come down to 6.0 percent and 5.25 percent.

RELATED: WISH grant provides first time homebuyers up to $22,000 for downpayment

“This is entirely dependent on the Federal Reserve’s ability to get inflation under control and ease up on its aggressive rate increases,” said Sharga.

To view Freddie Mac’s weekly data on interest rates visit https://www.freddiemac.com/pmms/pmms_archives?_gl=1%2Aia3e7v%2A_ga%2AMTg2MzMyMDg2MC4xNjc3ODY1MzY4%2A_ga_B5N0FKC09S%2AMTY3Nzg2ODU3MS4yLjAuMTY3Nzg2ODU3MS4wLjAuMA..