STATEWIDE – California Housing Finance Agency (CalHFA) announced that it would be accepting applications, beginning March 1, for the Accessory Dwelling Unit (ADU) grant. The grant provides homeowners with $40,000 reimbursements for pre-development costs associated with the construction of an ADU.

CalHFA previously said all funding for the program was fully reserved as of December 9, 2022 and put a pause on applications.

ADU Grant

In a Wednesday email news release, the agency said it is opening the ADU Grant portal back up for a modest number of new reservations due to canceled ADU Grant files.

“The portal will be open on March 1, 2023 at 9 a.m. and grants will be reserved on a first come, first served basis. Once CalHFA has received the number of desired reservations the portal will close immediately,” says the statement.

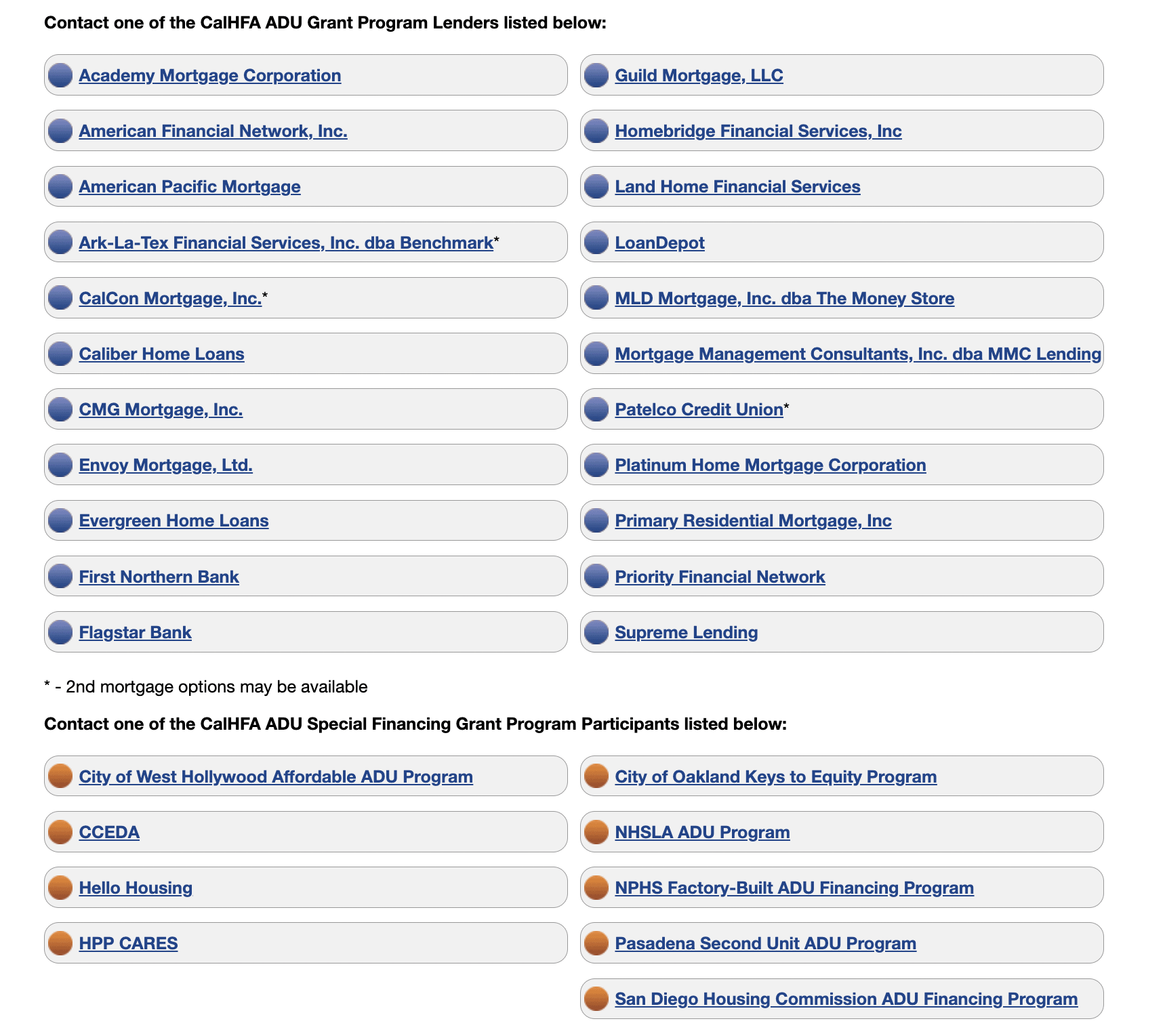

CalHFA ADU Grant Program Lenders have access to the grant portal. The agency advises approved lenders to ensure that any reservation for an applicant is fully vetted and does not have a reservation with another lender.

Low to moderate income homeowners are eligible to apply for funding.

California Housing Crisis

ADUs – also known as granny flats, in-law units, or backyard cottages, is a secondary housing unit on a residential lot. CalHFA implemented the grant program to address the housing crisis in California.

The recent passage of Senate Bill 9 allows for homeowners to build up to four homes on a single-family parcel, however, a recent report found that its impact has been limited so far.

“Planners told us that while applications for SB 9 have been low, inquiries to their departments about SB 9 are high,” says a January 2023 UC Berkeley report.

The study outlines how lawmakers can improve uptake of the housing law:

Create more prescriptive state standards for SB 9 homes

SB 9 uptake could be improved by creating more prescriptive land use and zoning standards to enable greater SB 9 feasibility.

Adopt more flexible local SB 9 ordinances

Local policymakers can consider adopting policies to improve SB 9 uptake, such as limiting fees and creating clear guidance and procedure for homeowners.

Address homeownership barriers

Legislators should reassess requirements under certain policies such as the Subdivision Map Act and construction defect liability laws which increase costs and deter the construction of homeownership projects.

“As California enters a period of increased economic uncertainty—as shown by the governor’s recent budget proposal and pending spending cuts—it is crucial to set up SB 9 for success now to ensure homeowners can make use of the law when economic conditions improve,” states the report.

For more information about the ADU Grant program visit https://www.calhfa.ca.gov/adu/