STATEWIDE – After distributing nearly $300 million in assistance to homeowners, the California Mortgage Relief Program announced Tuesday, that it is providing additional assistance – up to $80,000 for mortgage deferrals. The program has also expanded other eligibility requirements to help more homeowners who have struggled with housing payments due to the COVID-19 pandemic.

The program is expanding in four ways:

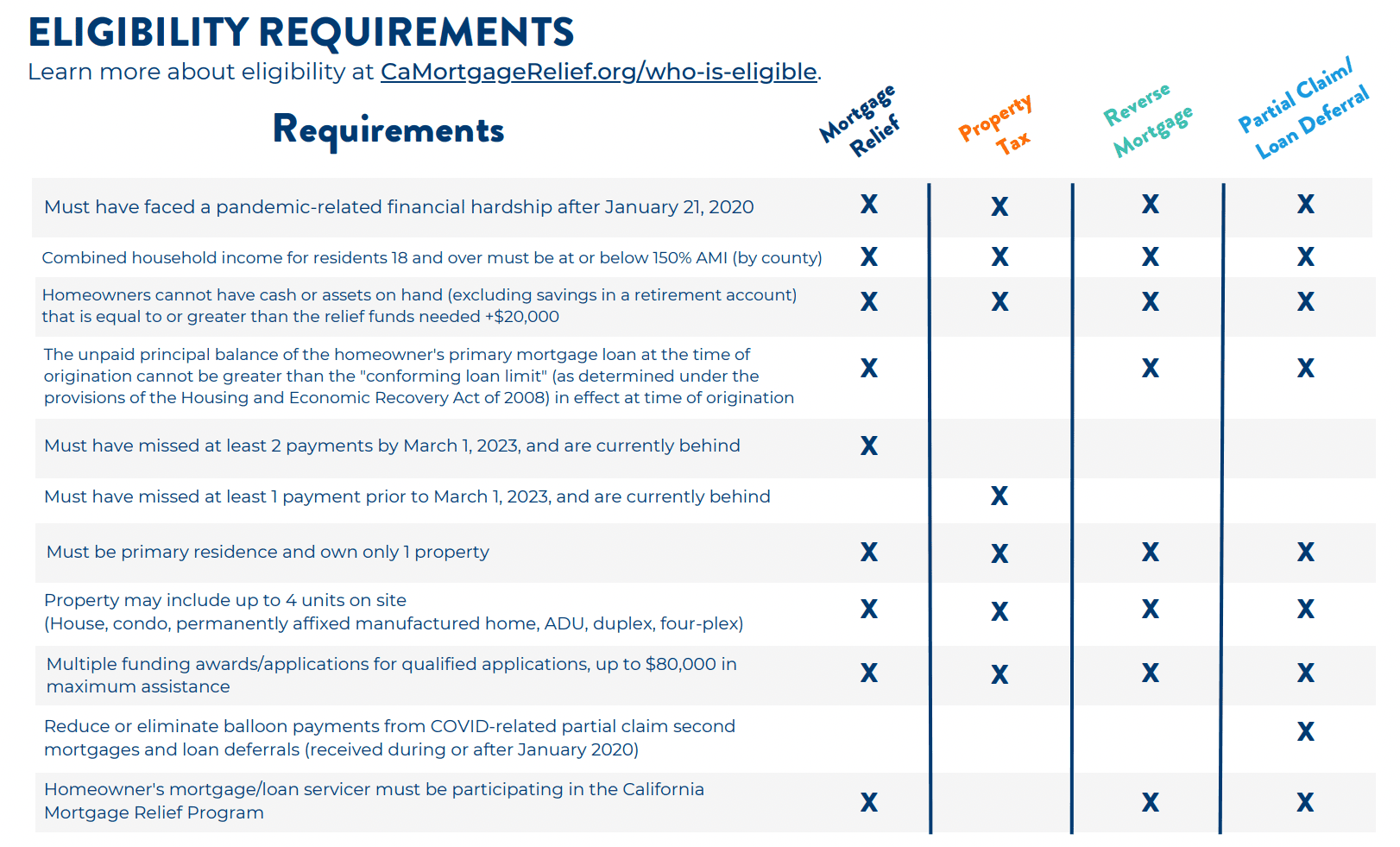

- Previously awarded homeowners who are still eligible and need more assistance can return for additional funds with a maximum of $80,000 in total assistance.

- Assistance is now available for homeowners with partial claim second mortgages or loan deferrals taken during or after January 2020.

- The delinquency date for assistance with past-due mortgage and property tax payments was reset. Applicants must have missed at least two mortgage payments OR at least one property tax payment prior to March 1, 2023.

- Homeowners with a primary residence that includes up to 4 units on the property may now be eligible.

“Since its inception, the California Mortgage Relief Program has been dedicated to helping California’s most vulnerable homeowners overcome the financial challenges brought on by COVID-19,” said California Housing Finance Agency (CalHFA) Director Tiena Johnson Hall.

Mortgage Deferrals

One major financial challenge brought on by the pandemic – mortgage deferrals.

Many homeowners who restructured their mortgages to save their homes, now face large payments at the end of their loan.

The expansion now includes grants to reduce or eliminate COVID-related partial claim second mortgages and loan deferrals.

Those who took a partial claim second mortgage or loan deferral during or after January 2020 may now be eligible for assistance.

“Using relief funds to pay down deferred balances for homeowners who experienced COVID hardships restores home equity and puts financially vulnerable families in a stronger position to sustain homeownership,” said National Housing Law Project Senior Staff Attorney Lisa Sitkin. “It also alleviates the anxiety of having to figure out how to pay off a large balloon payment in the future.”

Since its launch, the program has distributed grants to more than 10,000 California homeowners.

While there is no strict deadline for applications, CalHFA recommends homeowners in need apply as soon as possible.

Applicants will need to upload documents to determine eligibility. This may include mortgage statements, bank statements, utility bills, and income documentation (i.e. paystubs, tax returns, or unemployment documents). CalHFA says the application process can be completed in under 30 minutes after applicants have gathered all the required documents.

For more information about the California Mortgage Relief Program call 1-888-840-2594 between 8 a.m. and 6 p.m. Monday through Friday or visit online at CaMortgageRelief.org