STATEWIDE – The Workforce Initiative Subsidy for Homeownership (WISH) program can help aspiring homeowners overcome some of the biggest barriers to achieving their dream and building wealth – downpayment and closing costs.

During the 2021 – 2022 cycle, the WISH Program provided over $5 million to 234 first time California homebuyers with an average grant of $22,000.

For 2023, WISH grant provides eligible low- to moderate-income households 4-to-1 matching grants of up to $22,000. This means that for every $1 a homebuyer contributes toward the purchase of a home, the WISH program will match with $4.

Homebuyers can apply WISH funds to downpayment and closing costs for the purchase of the home.

To be eligible for WISH funds, the homebuyer must:

- have successfully completed a homebuyer counseling program.

- be a first-time homebuyer, as defined by the Bank in its AHP Implementation Plan.

- meet income eligibility guidelines, as published by the Bank at the time of enrollment in the WISH Program and is at or below 80% of the HUD area median income.

The homebuyer must also open escrow on a home purchase within one year of enrollment in the WISH program.

RELATED: Bank of America offering no downpayment, no closing costs, no credit score home loans

Homebuyer Contribution

Homebuyer contributions towards the purchase of the home can include savings, gift funds, or sweat equity.

Many participants combined WISH funding with the Union Bank Down Payment Assistance grant, CalHome Mortgage Assistance, and other programs. Funding from these programs are not considered homebuyer contributions.

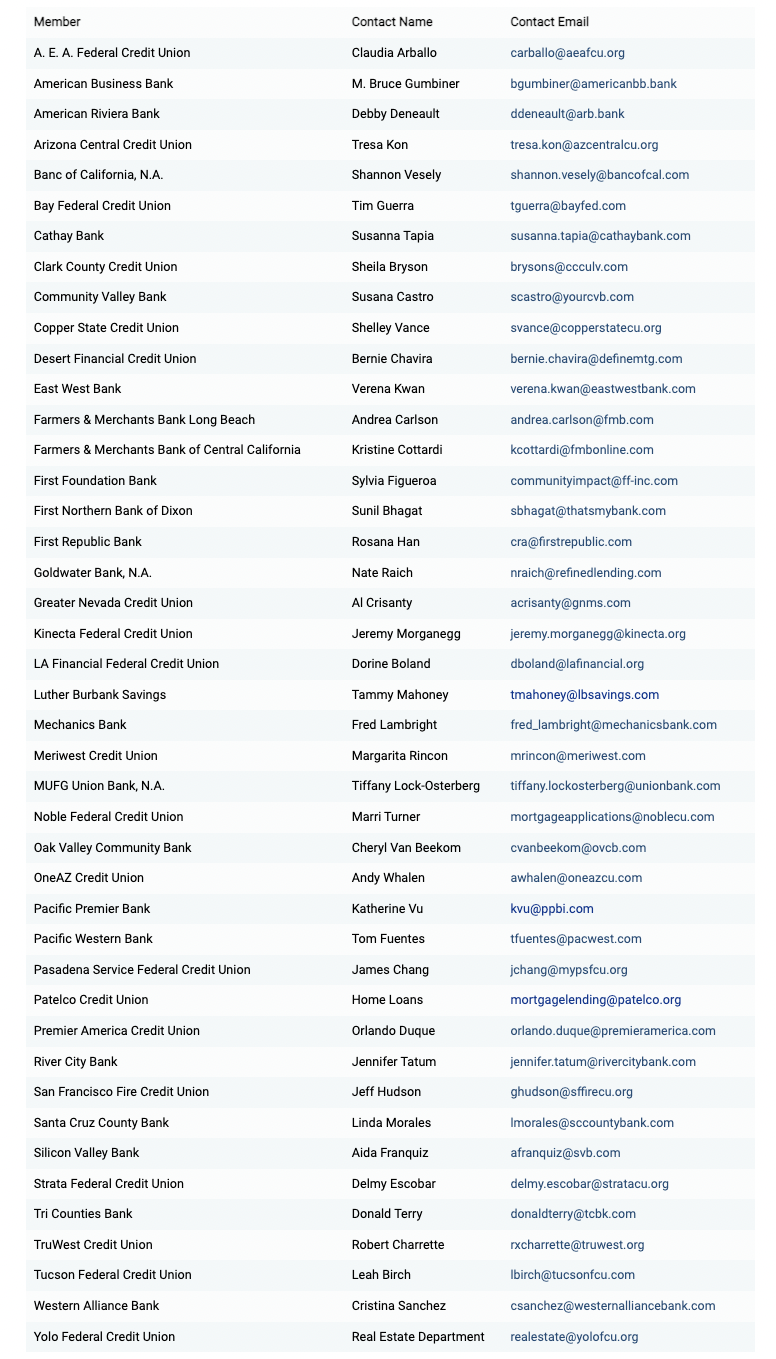

Interested homebuyers should contact one of the following members banks for more information about the WISH Program.

For more information about the WISH Grant Program visit https://www.fhlbsf.com/community-programs/grant-programs/wish?category=overview